Navigating Medicare in Retirement

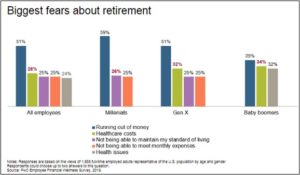

After the year that we endured in 2020, it comes as no surprise that healthcare is at the forefront of global discussion. If you look at any survey regarding Americans’ biggest fears about retirement, the cost of healthcare is consistently the first or second concern that respondents cite. This holds true across generations and was the case pre-pandemic and certainly remains the case today.

This concern is not unfounded, and the numbers can be daunting. Estimates from Vanguard data suggest the typical American couple will need about $197,000 for healthcare alone over the course of their retirement. The reason that number is shocking for many is because unlike many other budget items, such as groceries or utilities, healthcare costs are far less predictable. Pre-retirement, most have their healthcare subsidized through their employers. This can make it challenging to know what we spend on healthcare today, let alone what the costs might be in retirement.

Some of the factors that make healthcare costs hard to predict:

- Health status: High-risk status increases costs

- Medicare coverage choice: Premium and out-of-pocket trade-offs

- Retirement age: Bridging to Medicare

- Employer subsidies: Wide variation for workers versus retirees

- Geography: Where you live has an impact on coverage and costs

- Medicare surcharges: Income can increase premiums on Medicare Part B and D

Because of the complexity in predicting healthcare costs, many people treat it as a standalone item outside of their overall cash flow needs. In this article, we hope to provide a framework to help you evaluate your healthcare costs in retirement and be equipped when these expenses arise and decisions come knocking.

Medicare Policy Selection Framework

Medicare is a critical, albeit confusing, element of retirement. The concern of burdensome healthcare costs in retirement can be reduced by a four-step policy selection framework: Prioritize, Evaluate, Choose, and Revisit.

1. Prioritize- What is it you are seeking with your coverage? There are four criteria to consider:

- Affordability- Many individuals are simply looking to obtain the least expensive coverage over their lifetime. Of course, there are tradeoffs and lower premiums can result in large spikes in years that more health care is needed.

- Cost predictability – For some, the predictability of costs may be more important to clients than saving money on lower premiums. Unexpected medical bills for those that operate on a tight budget can be catastrophic. For those that fall into this category, knowing that “everything will be covered” may make pricier premiums worth the expense.

- Worst-case scenario protection – Some medicare options offer no limit to the amount an individual might pay for medical expenses in a given year. Other plans offer a cap. The lower that cap is, the more you will pay in premiums up front.

- Flexibility – Many coverage options use provider networks such as health maintenance organizations (HMOs) or preferred provider organizations (PPOs). Most networks are limited to one geographic area, which can be a problem if you travel or split time between locations, and network based plans can also limit your ability to see specialists or your preferred provider of choice.

2. Evaluate – Once you have considered the criteria above and prioritized which of these you place the most value in, the next step is to evaluate the types of coverage match your priorities the closest. However, before we look at how each type of coverage meets those criteria, let’s briefly define each of the five separate components of Medicare coverage.

- Part A (hospital coverage) – Part A pays hospital costs. It also includes some benefits for skilled home care, hospice care, and the first 100 days of skilled nursing care. Importantly, most individuals will not have to pay any premiums for Part A, as they paid for it through payroll taxes while working.

- Part B (medical coverage) – Part B covers outpatient healthcare visits such as doctors, outpatient surgery, diagnostic medical equipment, and ambulance services. Part B comes at an additional premium that starts at about $150 per month, but as we noted becomes more expensive with income over certain thresholds.

- Part C (Medicare Advantage) – Part C plans contract with medicare to provide Medicare A and B benefits. These bundled plans are often available for only the cost of the standard Part B premium. The vast majority of these plans follow the network model (HMO or PPO).

- Part D (prescription drug coverage) – Part D plans are optional prescription drug plans, but are available to everyone who is Medicare eligible. They are available as both standalone plans and as part of Part C Medicare Advantage plans. Like Part B, Part D coverage comes at the cost of an additional monthly premium, which is also subject to income thresholds that make coverage more expensive.

- Medicare supplemental insurance (Medigap) – Medigap consists of private policies that are designed to cover expenses not covered under Part A or Part B. These policies are commonly used to “fill the gap” that Part A and Part B leaves, namely by covering copayments, deductibles, and coinsurance. Medigap comes at an added cost as well, and you must be enrolled in Part and B in order to be eligible

Depending on the criteria you identified as most important to you in Step 1, the matrix below presents some policy types that might be most appropriate given your priorities.

Source: Vanguard Advisors

3. Choose – Once you have considered Steps 1 and 2 by prioritizing your needs and evaluating the policy type that fit your needs, you should be in a position to make an informed decision regarding your coverage options. While Medicare coverage may be one of the important decisions you may make in retirement, it’s important to note that it is not a binding decision, as there is an open enrollment period for current enrollees every fall. A resource to utilize in selecting your policy is your state’s State Health Insurance Assistance Program (SHIP), which offers free counseling about Medicare options and state-specific benefits you may be eligible for.

4. Revisit – The open-enrollment period mentioned above is open each year from October 15 through December 7. We recommend revisiting your selection annually, even if it means making no changes to your existing coverage.

Conclusion

Healthcare costs are difficult to forecast in both pre and post retirement. They are not easy to forecast for a variety of reasons, however, we do know they will increase for the vast majority of individuals and families. The reason for this is two-fold: 1. Over the past 20 years, healthcare costs have increased at a greater rate than general inflation and 2. As people get older, their need increases. It’s not an easy task to understand what your healthcare may cost in the future, however, we hope that by utilizing this four step process when it comes time to enroll in Medicare, you will be in a position to make an informed decision that fits your needs.