The College Savings Conundrum

Graduation season has come and gone! Congratulations to all those with children and grandchildren moving onto their next chapter of life. For those with loved ones heading to college this fall, the next several weeks are a great time to review the financial outlook for the next four years. For those with younger children or grandchildren, it’s never too early to start the conversation! The reality is retirement planning and education planning are inextricably linked. Overpaying for college and not optimizing your accumulated asset base to fund education expenses are some of the biggest deterrents to an on-time retirement. In this article, we will identify some of the critical elements of navigating the college planning discussion successfully.

Understanding the cost

College can be the most significant investment that a family will make, but rarely is it discussed that way—such as buying a house is. The all too frequent adage “if you get in, we will figure it out” can be a detrimental approach to your broader financial health. From 1983 to 2021, college tuition costs have increased approximately 850%, or 5.9% on an annual basis, which outpaces the cost increase seen by other consumer goods during the time period by a wide margin. The rising cost of college is the primary contributor to the $1.7 trillion of student loans owed by borrowers.

Source: BLS, Consumer Price Index, J.P. Morgan Asset Management

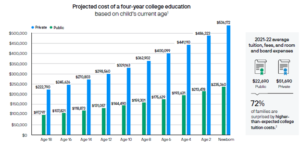

If you extend these trends into the future, the projected costs are staggering.

Source: The College Board, Trends in College Pricing and Student Aid 2021. J.P. Morgan Asset Management

While the effects of tuition inflation are shocking and have had massive ramifications to the global economy, the good news is that these statistics are based on the advertised “sticker” price, which can be misleading. Merit scholarships and need based grants paid for over 31% of college costs in 2019, and on average, private colleges discount their tuition 50.9%.

Financial planning for college requires more than just comparing tuition numbers. It is crucial to understand how financial aid is awarded. The following websites can be great resources in your research:

• collegescorecard.ed.gov

• collegeboard.org

• collegedata.com

• tuitionfit.org

Other important cost considerations include:

Understanding graduation rates

- 41% of undergraduates finish in 4 years

- 56% of undergraduates finish in 5 years

Understanding the value of the degree and major

- Consider starting salaries before choosing a major and deciding how much to spend on college costs and student debt

- As a rule of thumb, a student’s total loans upon graduation should not exceed their projected 1st year starting salary out of school

- Researching internship and co-op opportunities

Funding options

A 2019 Sallie Mae study showed that over 70% of families used current income to pay for college, and 14% withdrew from their retirement funds to meet these expenses. While supporting a child’s tuition expenses with employment income may be necessary, retirement accounts should be avoided at all costs – no college or university is worth the cost sacrificing retirement.

With that in mind, what are the best ways to save and pay for college? 529 education plans are a great place to start, especially while your child or grandchild is young.

- Tax Benefits

- Contributions are non-deductible, but earnings grow tax-free when the money is taken out for qualified education expenses – room, board, tuition, supplies, etc.

- Recent changes also allow tax-free withdrawals (up to $10,000 per year, per beneficiary) for elementary and secondary schools, apprenticeship and trade programs, as well as student loans

- Contributions are considered completed gifts for tax purposes, meaning up to $16,000 per individual/per year qualifies for the annual gift tax exclusion ($32,000 for couples who gift split); there is also a “super-funding” election to contribute as much as $80,000 in one year ($160,000 for couples who gift split) without generating a taxable gift

- Control, Flexibility, and Low Maintenance

- Unlike other custodial accounts, the donor keeps control of the account indefinitely which ensures that the money is used for its intended purposesAn account owner can change the beneficiary or rollover funds between accounts at any time without tax consequences, assuming the change is for a member of the family

- Unlike other custodial accounts, the donor keeps control of the account indefinitely which ensures that the money is used for its intended purposes

- An account owner can change the beneficiary or rollover funds between accounts at any time without tax consequences, assuming the change is for a member of the family

- The account owner can change the investment allocation twice per calendar year

- “Set it and forget it” – all plans offer an automatic investment plan, which keep the contributions coming in periodically as well as putting the investment allocation on a glide path towards starting college

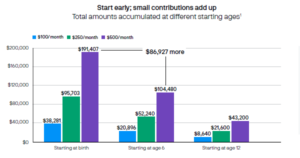

Don’t just save, invest. Whether you start a college fund in a 529 account or a custodial account, the most important thing is to get started in vehicles that maximize growth potential. It’s hard to overstate the benefits of compound interest:

Source: J.P. Morgan Asset Management, assumes an annual investment return of 6%

The End Goal

The earlier your family learns how to plan for college, the greater likelihood of reaching the educational goals for your loved ones. Allow your children to take responsibility in their education by involving them in the financial discussion. This helps put your student in charge of their education, giving it more value in the long run.